Summary

Yield Basis removes impermanent loss in Curve cryptopools by automatically keeping constant leverage via a special-purpose AMM.

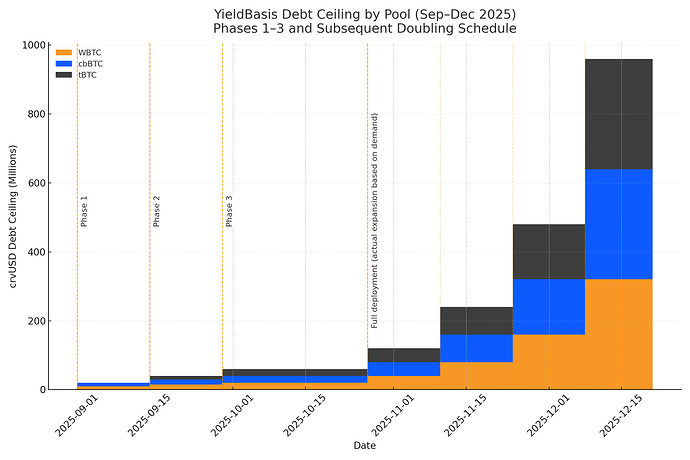

For operation, Yield Basis needs a credit line (implemented as a pre-mint allocation) of crvUSD, similarly to how crvUSD mint markets and PegKeepers operate. I propose to start from 60M crvUSD credit limit which will be enough to safely create 3 pools - for WBTC, cbBTC and tBTC capped for deposits up to $10M worth of BTC each. This is a comfortable minimum to have pools operating well on Ethereum mainnet.

The proposal below shows that:

- Yield Basis does not require any supply sinks for crvUSD (it is a supply sink for itself);

- Yield Basis returns value equal to 35%-65% of what veYB is getting back to Curve / veCRV;

- An efficient use for YB tokens granted to Curve is proposed (vote incentives for crvUSD stablecoin pools).

Borrowing, supply sinks and scalability

In typical borrow markets (such as crvUSD mint markets), a user who borrows any amount of debt d will sell it for one or other purpose (for example, to sell it for redeemable stablecoins, or for more collateral if they use borrowing to create a leveraged position). This creates a price pressure -d on crvUSD which gets absorbed by crvUSD pools and PegKeepers but increases borrow rate. In order to zero out this effect on crvUSD, part of the borrow rate is given to Savings crvUSD, or incentives are given to create some other supply sink for crvUSD, hopefully to absorb +d amount of crvUSD. The latter is not too easy, so this presents a fundamental challenge of scaling crvUSD (or any other CDP), not being able to satisfy the demand for loans without creating a corresponding demand to HODL the stablecoin.

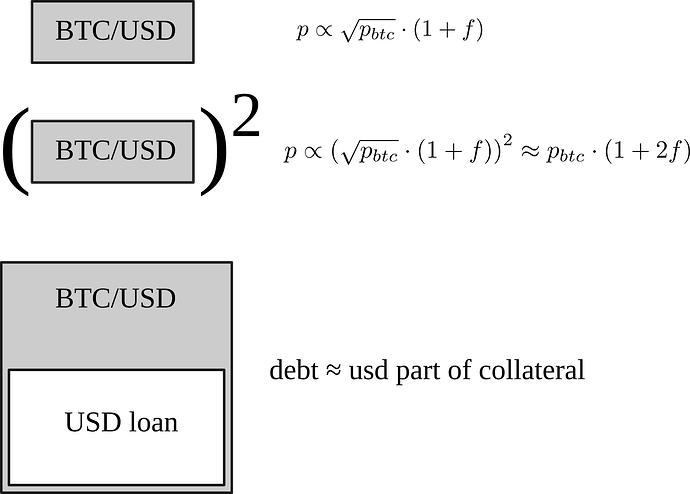

When Yield Basis borrows crvUSD, the supply sink problem is solved. Curve cryptoswap AMM consists of x amount of stablecoin and y amount of cryptocurrency (a bitcoin wrapper). Yield Basis AMM borrows d amount of debt which on average is having the size of half TVL of the pool: if price of Bitcoin is p, time-averaged values for a pool with constant TVL \left<x\right>_t=\left<py\right>_t=\left<d\right>_t.

This means that Yield Basis simultaneously borrows and makes a supply sink for the same amount of crvUSD. Therefore, TVL and debt in Yield Basis can scale up to any size without affecting crvUSD peg negatively.

Borrow rate usage

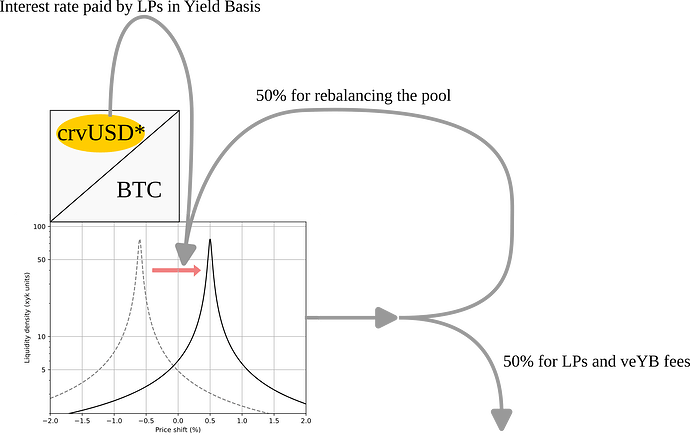

In Yield Basis, 100% of borrow rates paid by LPs are directed to refill the budget used for rebalances in Curve cryptopools. In addition, 50% of trading fees in this pool, as usually, also refill the same budget.

The other 50% of the fees generated in the pool are the revenue which gets split between Yield Basis (veYB holders) and liquidity providers (who hold liquidity as ybBTC tokens). So, 100% of the borrowing fees are going back to support the pool’s liquidity. So Curve ecosystem is not getting value from this stream. Instead, it gets value via different ways: crvUSD<->redeemableUSD exchanges, and having a part of YB token allocated to Curve ecosystem.

crvUSD stableswap trading fees

Yield Basis earns fees from BTC wrapper trades, for example BTC<->crvUSD. However, crvUSD is rarely the final stablecoin users (mostly arbitrage traders) need. Typical arbitrage paths can look like:

wBTC->crvUSD->USDT or USDT->crvUSD->WBTC.

Therefore, the same volume as happening in wBTC<->crvUSD pool (which has no admin fee) also occurs in crvUSD<->USDT and similar pools. Those trading volumes contribute to system revenues as:

- 50% of stablecoin pool fees go to veCRV holders;

- the other 50% of stablecoin pool fees go to LPs of those pools.

- That makes pools more attractive for deposits and, therefore, as a supply sink for crvUSD, which eventually results into more mints of crvUSD which get revenues to veCRV holders.

Therefore, it is fair to say that all the fees which get charged by crvUSD stableswap pools will eventually end up as revenues for veCRV holders, one or other way.

Let’s calculate revenues which Curve will get from those. Let’s assume that fee of stablecoin pools is equal to what it is now (f_s=0.01\%=10^{-4}), and all the trading volumes happening in cryptopools related to Yield Basis will also create the same trading volumes in crvUSD stablecoin pools.

Stablecoin pool which had volume V over time t earning rate per TVL can be found as:

r_s=\frac{f_s V}{t\cdot TVL_{yb}}=2 f_s \frac{V}{t\cdot TVL_{cryptopool}}.

For the sake of an estimate, let’s assume that the ratio of this rate to YB fundamental earnings rate (APR) is constant:

R_s=\frac{r_s}{r_{YB}}=\text{const}.

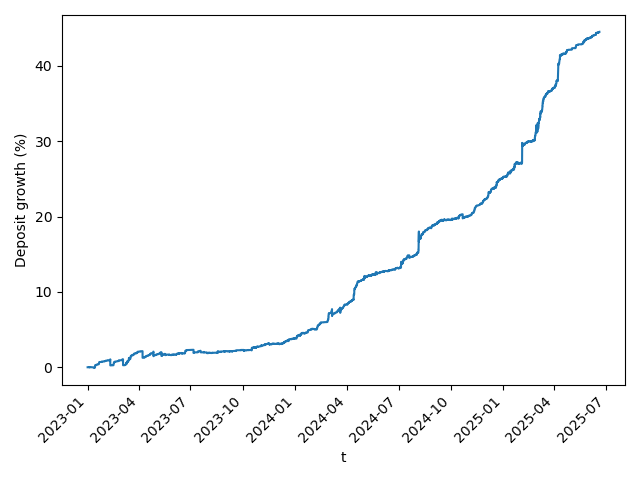

We can find this ratio from simulations over historic data from 2023 till July 2025. Growth of deposits based on these simulations is provided:

From these simulations:

- Total time simulated: 905 days;

- V/(t\cdot TVL_{cryptopool})=23.57~\text{year}^{-1};

- r_{yb}=14.87\% - average fundamental APR in Yield Basis pool;

- r_s=0.47\%;

- R_s=0.03172 - fraction of stableswap returns vs returns of Yield Basis pools before any admin fee mechanics is applied.

Yield Basis as a system applies admin fee which ranges between 10% and 100% to r_{yb} (10% is when nothing is staked to earn YB token). So earnings for Curve from crvUSD pools can reach up to 31.7% of what Yield Basis earns (that is if nothing is staked).

YB allocation for Curve

In order to get more incentives for Curve ecosystem as well as to pay a fee for having Curve technology (cryptopools) powering its core, Yield Basis makes an allocation equal to 25% of YB which Yield Basis liquidity providers are getting to Curve. One can count that as inflation, so Curve ecosystem will always get 20% of total YB inflation (let’s call this number i_c). That already allows to estimate value which Curve ecosystem will be routinely getting from Yield Basis.

Total revenues for Curve ecosystem

Let’s calculate how much Curve is getting from inflation as well as the total value which one gets for Curve. For that, we will need to have a loosely set parameter k which has a meaning of ratio of YB token inflation to the revenues which the Yield Basis system is getting. In DeFi projects which generate and distribute value derived from their operation this parameter is currently around k=2 while sustainable operation would assume k=1. We’ll calculate revenues generated for Curve for k ranging from 0.5 to 3.

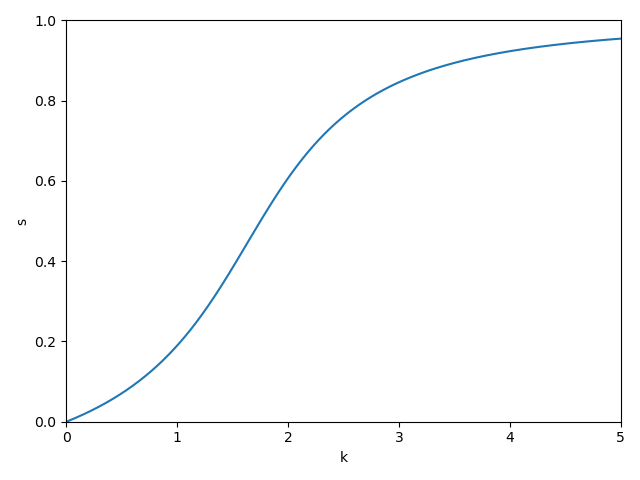

YB inflation is dynamic and depends on fraction staked s (which can range from 0 to 1):

I=I_0 \sqrt s;

Admin fee in Yield Basis is also dynamic:

f_a = 1 - (1 - f_0)\sqrt{1 - s},

where f_0=10\% is minimal admin fee (which is reached when s=0).

Return rate which LPs in Yield Basis are getting earns from what is left after charging admin fee, but only gets distributed to those who did not stake (1-s of all):

r_{unstaked} = \frac{(1-f_a)\cdot r_{yb} \cdot TVL_{yb}}{1-s}.

As we hypothesized, the value of emissions should be k times larger than the admin fee which gets into pockets of veYB holders. Let’s also normalize it to the fraction of depositors who staked (s).:

r_{staked}=\frac{k\cdot TVL_{yb}\cdot r_{yb}\cdot f_a}{s}.

In efficient markets, both staked and unstaked rates should equalize, e.g. r_{unstaked}=r_{staked}. This leads to:

\frac{1-f_a}{1-s}=\frac{kf_a}{s}.

When we substituting f_a, we arrive at:

k=\frac{s(1-f_0)}{\sqrt{1-s}\left(1 - \left(1 - f_0 \right)\sqrt{1-s} \right)}.

We solve it for s graphically and calculate rate of returns which Curve is getting from emissions normalized to what veYB is getting, summarized in the table:

| k | Optimal staked s | crvUSD stableswap returns R_s | YB inflation returns | Total Curve returns from Yield Basis |

|---|---|---|---|---|

| 0 | 0% | 31.7% | 0% | 31.7% |

| 0.5 | 7.1% | 23.9% | 10% | 33.9% |

| 1 | 19% | 16.7% | 20% | 36.7% |

| 1.5 | 38% | 10.9% | 30% | 40.1% |

| 2 | 60.7% | 7.28% | 40% | 47.3% |

| 2.5 | 76% | 5.67% | 50% | 55.7% |

| 3 | 84.5% | 4.91% | 60% | 64.9% |

In this table, k=2 is typical for revenue-distributing projects, k=1 is sustainability (e.g. when inflation = distributed revenues) and k=0 is a corner case of YB token being valued at 0.

So, Curve is realistically getting total value somewhere from 35% to 65% of what veYB holders are getting from fees.

Efficient use of YB tokens in Curve

Inflation-like stream of YB tokens given to Curve can be used in multiple ways (initially controlled by veCRV). I propose to use this stream to incentivize votes for stablecoin pools like crvUSD/USDC, crvUSD/USDT, crvUSD/pyUSD, crvUSD/USDf, crvUSD/frxUSD and alike. This will improve crvUSD supply sinks (which will eventuall create more revenue via crvUSD minting), increase crvUSD liquidity and provide revenues to veCRV and vlCVX as vote incentives.

The emissions are to be controlled by veCRV holders initially although they can grant access to distribute those to anything (smart contract, multisig etc) in a later proposal. The suggestion to use YB tokens for crvUSD stableswap vote incentives is not a part of this particular proposal but a suggestion for next proposals.