Summary:

- Proposal 1 is no longer relevant, as bad debt in mint markets has already been cleared.

- Re: Proposal 2, we recommend a targeted ≈100k crvUSD repayment in the CRV lend market, reviewed monthly.

- Continue simulations and parameter optimization to reduce the likelihood of bad debt accrual in mint and lend markets.

- Use this as an opportunity to define the treasury’s role and operational framework.

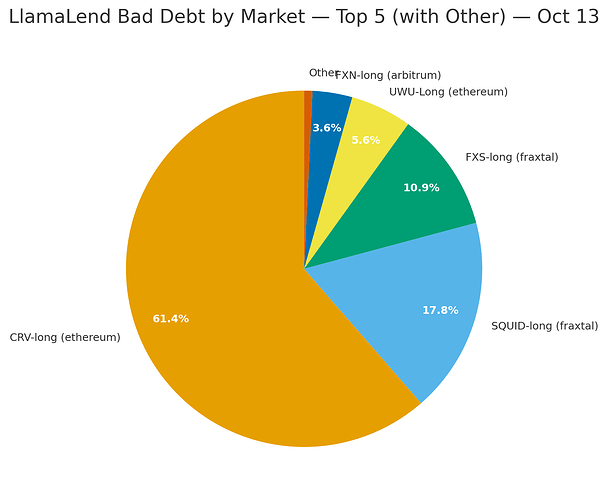

CRV Market Bad Debt Analysis

Key findings:

- Two large positions account for roughly one-third of total bad debt.

- Around two-thirds of shortfalls fall below Pᵢ = 1.2, meaning most positions would naturally clear if CRV returned to ≈ $1.20–$1.50.

- A targeted 100,750 crvUSD paydown across seven addresses would bring all positions to Pᵢ ≤ 1, making them liquidatable again around $1 CRV.

We recommend a gradual, data-driven intervention focused on those positions, reassessed monthly, rather than a one-off full treasury drain. This materially improves market health while avoiding moral-hazard concerns and preserving funds for future events.

The majority of the bad debt is concentrated in the CRV-long market on Ethereum. We will focus on a plan to address this market in particular.

Given below is a list of all accounts in CRV-long market that have a shortfall greater than 10 crvUSD (assuming CRV=$0.60).

- x_crvUSD: collateral held as crvUSD

- y_CRV: collateral held as CRV

- debt_crvUSD: crvUSD debt outstanding

- P_i: Price of CRV when debt_crvUSD = collateral_crvUSD

- shortfall@CRV=$0.6: Bad debt per account assuming CRV = $0.60

| user | x_crvUSD | y_CRV | debt_crvUSD | P_i | shortfall@CRV=$0.6 |

|---|---|---|---|---|---|

| 0x82925fbee7060FB6B23600A92Ff1C04735DE0b99 | 119,277.103376 | 143,735.344880 | 317,512.499229 | 1.379169 | 111,994.188925 |

| 0xD76AA47f1Ad6ce7f78ddCD4643A85C87B7e7C047 | 0.000000 | 475,457.510796 | 355,715.307921 | 0.748154 | 70,440.801443 |

| 0xe69A49F8F9C1d66fefA66Dfb61155c06606986D1 | 20,257.935575 | 209,244.065041 | 211,875.531155 | 0.915761 | 66,071.156556 |

| 0x6e22c49c85de053107fEA6E09ffFbC4b5029C5f1 | 26,119.558235 | 82,598.383557 | 121,983.662186 | 1.160605 | 46,305.073816 |

| 0x6bE91cbC96071e3F1Cb79b50deF8D59a016Fa1c6 | 117,398.293306 | 25,567.575575 | 174,245.132652 | 2.223396 | 41,506.294001 |

| 0x6620912AC168458ED84D5D3d6c83E728abf9941F | 3,017.898506 | 104,446.802791 | 90,221.556576 | 0.834910 | 24,535.576395 |

| 0x3b96f28e3B45a19FA3e89232D0680E54872D3d58 | 8,251.692706 | 44,399.468251 | 53,533.435243 | 1.019871 | 18,642.061586 |

| 0x1cABC2a3E7fD58B16502bF7c60c5a5e41b9Db638 | 2,047.516991 | 70,862.755326 | 60,795.030895 | 0.829032 | 16,229.860707 |

| 0xFfb3Cad58bb14eeDDfDd077c99c73e96Feb1602a | 0.000000 | 113,212.863944 | 80,411.481786 | 0.710268 | 12,483.763420 |

| 0x1Fdf62394aBDa67BE5346f9eA426A447Bf602Fcc | 2,347.104457 | 24,243.224380 | 24,945.113559 | 0.932137 | 8,052.074475 |

| 0x72Ec1Fd9929A854719d9A1a2aFc7fFcd7C0C7DeE | 1,977.990369 | 20,430.647730 | 20,335.199486 | 0.898513 | 6,098.820480 |

| 0x802d8Db785bD165125D5907A5F67Ce3E4012C384 | 2,016.404320 | 10,849.565391 | 13,019.958207 | 1.014193 | 4,493.814652 |

| 0x0fc6144F9eA35EE67Ee4e38c5Ea47B2960C13Ccc | 2,373.724206 | 8,127.700245 | 9,766.064433 | 0.909524 | 2,515.720079 |

| 0x2400a45243e6B13dbaF549FCAc88Eda203df80D2 | 0.000000 | 29,776.768597 | 20,060.381751 | 0.673692 | 2,194.320593 |

| 0x8D7E07b1A346ac29e922ac01Fa34cb2029f536B9 | 0.000000 | 86,234.073951 | 53,695.934328 | 0.622677 | 1,955.489958 |

| 0x36bF825269bCD6988a491c04053e0855d445db97 | 985.231112 | 3,373.459784 | 4,919.633470 | 1.166281 | 1,910.326487 |

| 0x28949AEdec812949Ff872bF13dA323Ce5bc82728 | 785.183149 | 4,440.471087 | 5,333.867305 | 1.024370 | 1,884.401503 |

| 0xbbc84a064d7FD00F2383A6b0faFf8c78C7517eB2 | 367.495650 | 2,078.309768 | 2,534.924400 | 1.042881 | 920.442889 |

| 0xcbcE52b5576771C7c8F5C21E29640D29E9636a8F | 342.772142 | 1,938.490130 | 2,361.152526 | 1.041213 | 855.286306 |

| 0x21F4aA70F4C375b6Ee91570A1e1D86FDE4Cad098 | 0.000000 | 13,925.825476 | 9,171.955371 | 0.658629 | 816.460086 |

| 0x38F4362d888985a8ef4B9Cc9E51277C13Aca5C37 | 0.000000 | 4,521.292674 | 3,501.571669 | 0.774463 | 788.796064 |

| 0xe5b2a2459914B78F52bEF1d294605EfC91E311a3 | 0.000000 | 15,087.071277 | 9,608.400061 | 0.636863 | 556.157295 |

| 0x50de06228FB5b6ba51e4d40AA93d16B9BeFBaE7E | 0.000000 | 3,065.018009 | 2,361.159556 | 0.770357 | 522.148751 |

| 0xA903f50Fe59B8939443e818b2451f4f1e021BcE4 | 0.000000 | 8,951.236373 | 5,885.728674 | 0.657532 | 514.986850 |

| 0x477A3cC7c323607510f6b5555Cc2e30FE4B4fC6A | 0.000000 | 20,433.985122 | 12,752.588902 | 0.624087 | 492.197829 |

| 0xcc433e8c820900aba3CC7F54A5076F426183f99F | 0.000000 | 1,571.416806 | 1,060.568953 | 0.674913 | 117.718869 |

| 0x1b7A9C831B4f2088FA6eaE337088ae2Fc9913ef5 | 0.000000 | 462.418212 | 350.984650 | 0.759020 | 73.533723 |

| 0x7Ae37200fbc08e1cb786059934f671fbE62d7c0f | 13.869631 | 47.490018 | 67.666698 | 1.132808 | 25.303056 |

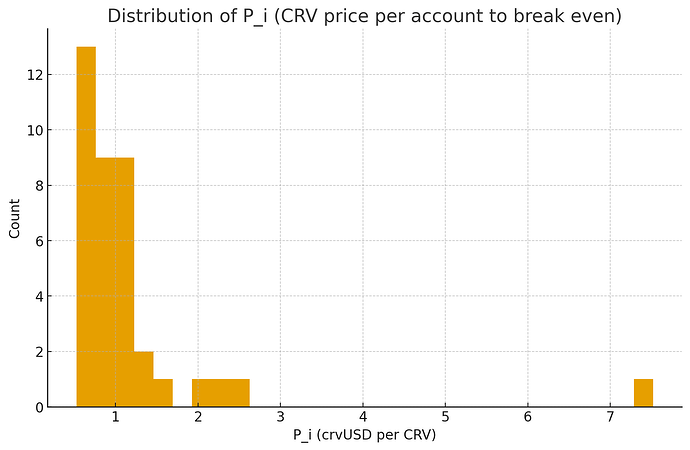

Taking a closer look at the distribution of P_i, the majority of accounts are below 1.5, meaning bad debt in the majority of accounts can be cleared if CRV reaches a price of $1.5.

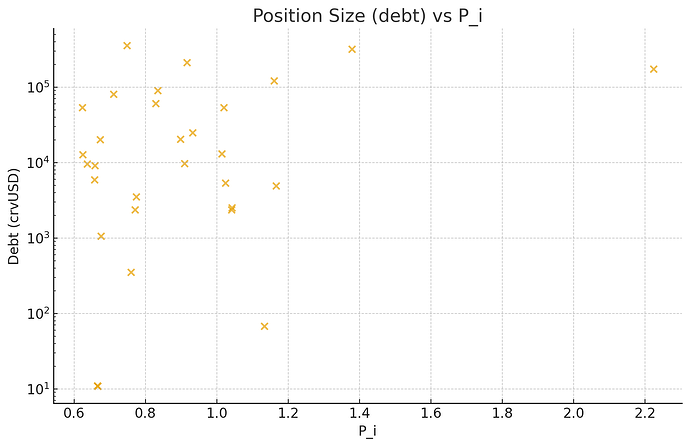

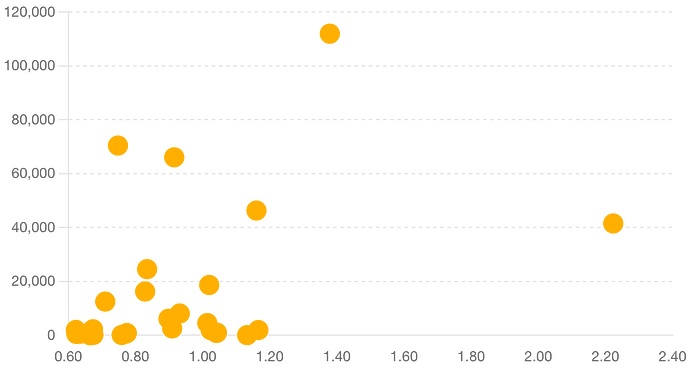

The outstanding crvUSD debt of accounts greater that 10 is shown below.

Around 2/3 of the total shortfall is below P_i = 1.2. Two large user positions account for 1/3 of the outstanding debt and greatest shortfall (0x82925fbee7060FB6B23600A92Ff1C04735DE0b99 and 0x6bE91cbC96071e3F1Cb79b50deF8D59a016Fa1c6).

See also, shortfalls scaled linearly.

If no action is taken, the approximate bad debt at different prices of CRV (P) are:

- P=0.50 → ~595,913 crvUSD

- P=0.80 → ~200,765

- P=1.00 → ~100,927

- P=1.20 → ~51,920

- P=1.50 → ~18,497

- P=2.00 → ~5,713

Recommendation

The table below includes accounts with over 1k shortfall when CRV=0.6 and where P_i is higher than 1. It gives the crvUSD repayment required to bring the shortfall of each account down to P_i = 1, meaning the accounts would then become liquidatable when CRV = ~$1.

| user | debt_crvUSD | P_i | shortfall@CRV=$0.6 | paydown_to_1 |

|---|---|---|---|---|

| 0x6bE91cbC96071e3F1Cb79b50deF8D59a016Fa1c6 | 174,245.132652 | 2.223396 | 41,506.294001 | 31,279.263771 |

| 0x82925fbee7060FB6B23600A92Ff1C04735DE0b99 | 317,512.499229 | 1.379169 | 111,994.188925 | 54,500.050973 |

| 0x36bF825269bCD6988a491c04053e0855d445db97 | 4,919.633470 | 1.166281 | 1,910.326487 | 560.942573 |

| 0x6e22c49c85de053107fEA6E09ffFbC4b5029C5f1 | 121,983.662186 | 1.160605 | 46,305.073816 | 13,265.720394 |

| 0x28949AEdec812949Ff872bF13dA323Ce5bc82728 | 5,333.867305 | 1.024370 | 1,884.401503 | 108.213069 |

| 0x3b96f28e3B45a19FA3e89232D0680E54872D3d58 | 53,533.435243 | 1.019871 | 18,642.061586 | 882.274285 |

| 0x802d8Db785bD165125D5907A5F67Ce3E4012C384 | 13,019.958207 | 1.014193 | 4,493.814652 | 153.988495 |

This totals 100,750 crvUSD required to bring the total bad debt exposure in the CRV-long market within a range of P_i <= 1.

We recommend to address the most egregious shortfalls in the market firstly by paying down 100,750 crvUSD to the seven accounts listed above. This should be reassessed on a monthly basis. This will have the following implications for bad debt at different prices of CRV:

| CRV price | Before paydowns | After paydowns | Reduction |

|---|---|---|---|

| 0.50 | 595,912.79 | 495,162.33 | 100,750.45 |

| 0.80 | 200,765.47 | 100,015.02 | 100,750.45 |

| 1.00 | 100,927.31 | 176.86 | 100,750.45 |

| 1.20 | 51,920.06 | 1.33 | 51,918.73 |

| 1.50 | 18,496.57 | 1.10 | 18,495.48 |

| 2.00 | 5,712.52 | 0.84 | 5,711.69 |

While there are no guarantees about price performance to organically clear the debt at certain price targets, the lend market is also not critical to crvUSD stability and steps should be taken to minimize expense to the treasury as much as reasonably possible while ensuring that the market does ultimately resolve the accumulated bad debt.

Note on Treasury Purpose and Framework

This incident also underscores the importance of having a clearly defined treasury purpose and management framework. At present, the treasury’s role is somewhat implicit — initially accumulated to act as a backstop for crvUSD — but not formally codified. We recommend that the DAO:

- Clarifies the mandate of the treasury (e.g. risk backstop, ecosystem development, market support).

- Establishes rules and thresholds for when treasury intervention is warranted (e.g. max % allocation for bad debt, liquidity support, etc.).

- Defines governance and reporting mechanisms for treasury deployment and replenishment.

Such a framework would improve transparency, guide expectations, and strengthen Curve’s resilience in future market drawdowns.

Future Risk Mitigation

In parallel, we are running simulations and recalibrating market parameters for the CRV lend market and other highly volatile lend markets (e.g., FXS, ARB). The goal is to reduce the likelihood of similar bad debt formation during sharp price crashes and to ensure liquidation efficiency under extreme volatility scenarios.

We will be putting up a vote shortly to modify parameters in the CRV-long market that aims to reduce future unsafe borrow exposure without impacting existing borrow positions.