Summary:

Replace Semilog Monetary Policy contract in the sfrxUSD-long LlamaLend market on mainnet with a new EMAMonetaryPolicy contract.

Abstract:

The new Monetary Policy contract is based off the SusdeMonetaryPolicy that was used in prod for the sUSDe-v2-long LlamaLend market for some time (it has since been reverted to Semilog).

The new EMAMonetaryPolicy maintains the same concept of calculating the APR of the yieldbearing collateral and using it as a reference to set the market’s borrow rate at target utilization. It uses an EMA to smooth the rate adjustment, mitigating any anomalies or attempts to manipulate the rate. This monetary policy strategy offers advantages over Semilog by dynamically conforming the borrow rate to the yield earned on the underlying. This is useful for leverage looping strategies on like-kind assets.

The adapted contract has been made generic to streamline deployment of similar monetary policies for other yieldbearing stablecoin markets. Usage requires a calculator to determine the rate of rewards distribution. The contract has implemented several other changes, including a minimum rate of 1% and a check on calculator revert to prevent breaking the market in such a case. The EMA time has also been substantially reduced.

Motivation:

There has been a clear adoption trend in LlamaLend markets indicating that yieldbearing stablecoin (YBS) markets are highly desirable. These markets have a particular use case that make them viable only when borrowers can profitably leverage their exposure to the YBS. Semilog Monetary Policy is somewhat inflexible to this use case, since it derives rates purely from market utilization. This may require significant active management to optimize markets as interest rates evolve. The EMAMonetaryPolicy’s feature is to auto-optimize the market based on the underlying APR, avoiding the need for active management. This will help markets operate closer to a target utilization, reducing the need for borrowers to actively manage their positions and improving returns for lenders.

Specification:

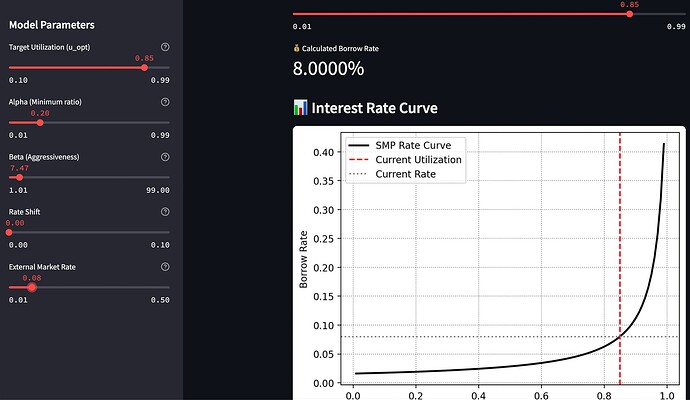

According to the rate calculator, the current yield on sfrxUSD is 8.065%. The MonPol has been deployed with the following parameters (which are settable by the DAO):

- Target Utilization: 85%

- Min Ratio: 0.2x

- Max Ratio: 7.2x

- Shift: 0

This configuration means the rate at 85% market utilization is ~8%. The min rate is ~1.6% and the max rate is ~57.6%. The curve will adjust up or down depending on the rate given by the sfrxUSD rate calculator.

Vote actions:

CONTROLLER = "0x3DE37c38739dFb83b7A902842bF5393040f7BF50"

ACTIONS = [

(CONTROLLER, "set_monetary_policy", "0x5ec3a823c1477b30036Fa0419b834c5Ec2B29504')

]