Summary

Optimize USDC/fxUSD liquidity pool by ramping A parameter from 500 to 1200 over one week.

Abstract:

Increasing the A value concentrated liquidity in the pool, allowing allowing more efficient arbitrage by reducing slippage in the pool. This can improve order flow capture to the pool, especially for large swap sizes, but can exacerbate the pool imbalance in case either token goes off peg. Increasing A may be advisable when the constituent tokens demonstrate a history of strong or improving peg performance.

Motivation:

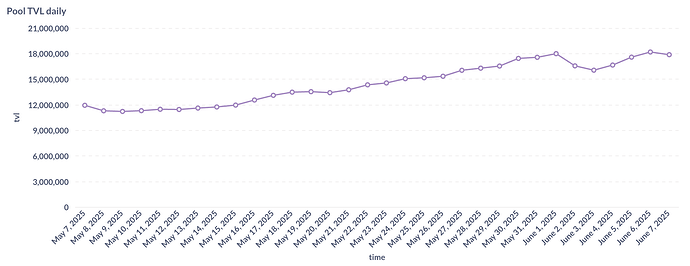

Over the past month, the USDC/fxUSD pool has seen growth from $12m to $17.8m TVL.

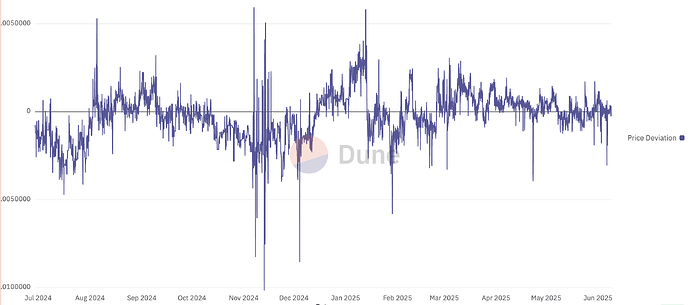

Since pool creation on Curve in June 2024, fxUSD has maintained a relatively strong peg. The spread between fxUSD and USD has become more stable over the past few months, typically remaining within a 30 basis point range. For reference, USDT typically stays within a spread range of 15 basis points.

Increasing pool TVL and exhibiting a strong peg make the USDC/fxUSD pool a good candidate for increasing the A parameter value.

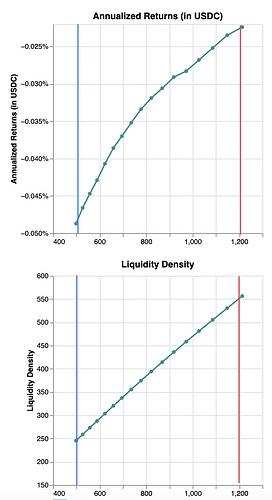

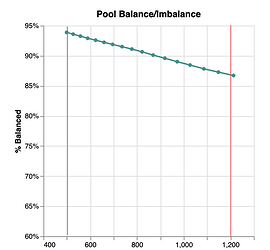

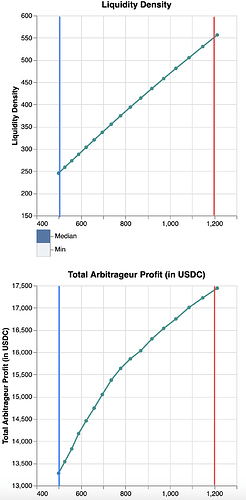

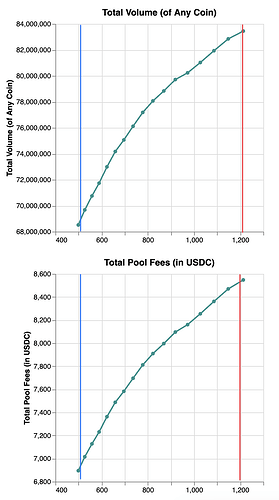

In the simulations below, the blue line represents the current A parameter value of 500, while the red line indicates the proposed increase to 1200. The values shown in the graphs are all median values of the simulation.

These simulations indicate that ramping parameter A to 1200 is reasonably safe and provides several benefits for the USDC/fxUSD pool such as:

- Increased arbitrage volume

- Overall increase in pool volume

- Greater liquidity density

- Better returns for liquidity pool providers

Increases to A will increase the severity of pool imbalance if either token loses its peg, but the potential benefits of the parameter change appear to outweight potential drawbacks. In fact, simulations suggest that the pool can safely tolerate higher values of A, but this moderate ramp up allows us to observe the performance of the pool to assess opportunities for additional optimization.

Specification:

RAMP_TIME = chain.time() + (86400 * 14)

ACTIONS = [

# USDC/fxUSD ramp A to 1200 over 1 week

("0x5018BE882DccE5E3F2f3B0913AE2096B9b3fB61f", "ramp_A", 1200, RAMP_TIME),

]