Summary:

Increase liquidity concentration in Curve PegKeeper pools by ramping A parameter from 500 to 2000 over one week.

Abstract:

The following pools are included in this vote:

These include all pools that are the target of crvUSD PegKeepers where the protocol directly mints and burns crvUSD to ensure a strong stablecoin peg.

Motivation:

Several factors have recently contributed to crvUSD maintaining a tighter peg and for PegKeepers to consistently maintain a buffer of protocol-minted crvUSD:

- scrvUSD was deployed in November 2024, sharing a portion of protocol revenue with depositors to the vault and creating a reliable supply sink for the stablecoin.

- Resupply launched in March, generating a substantial amount of demand for crvUSD that allows users to leverage supply to LlamaLend markets.

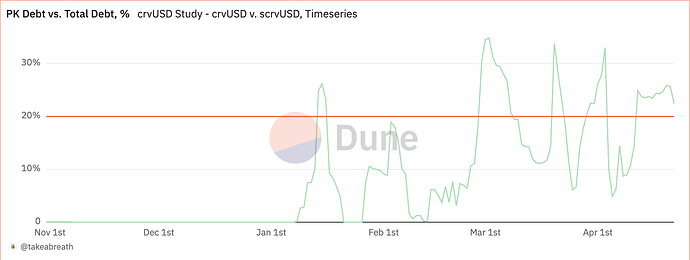

- A vote executed in April to increase the targetFraction in the crvUSD monetary policy from 10% to 20%. Effectively this increases the average proportion of PegKeeper debt by making crvUSD mint rates less sensitive to changes in debtFraction.

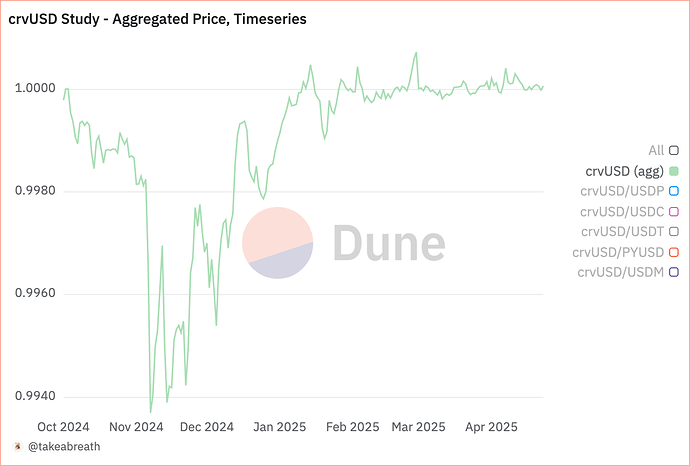

See below, as of January 2025 and thanks to these combined factors, the peg has noticeably strengthened and PegKeepers have become much more active.

(Source: https://dune.com/takeabreath/scrvusd-growth)

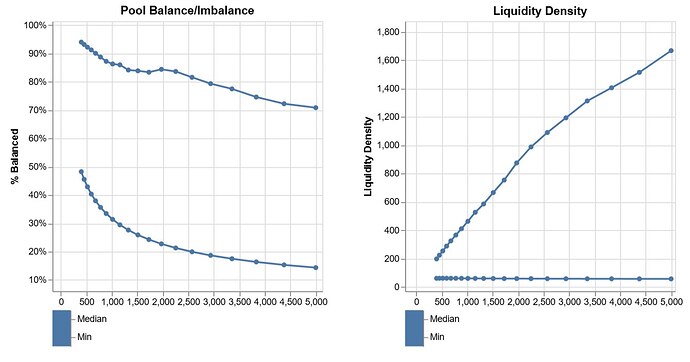

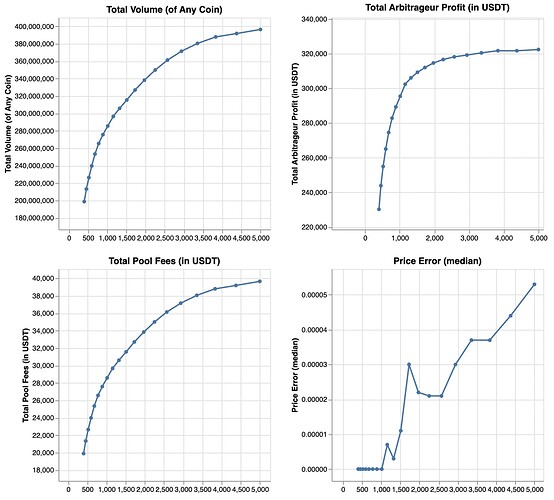

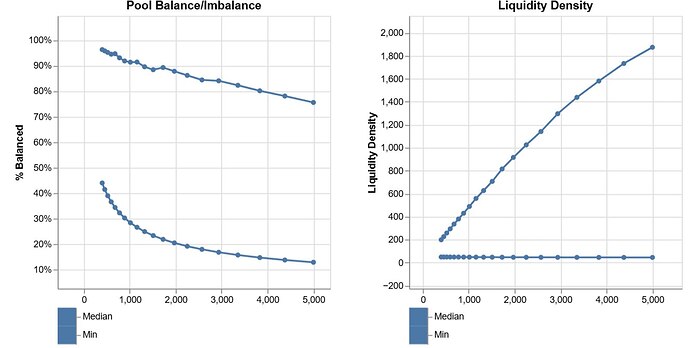

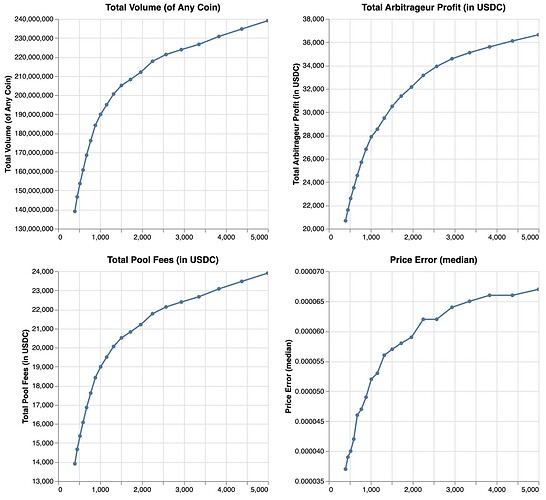

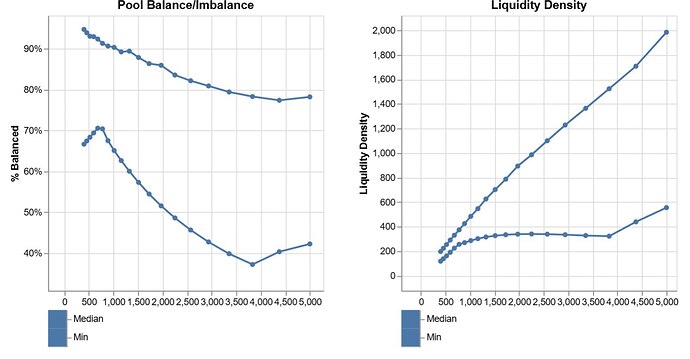

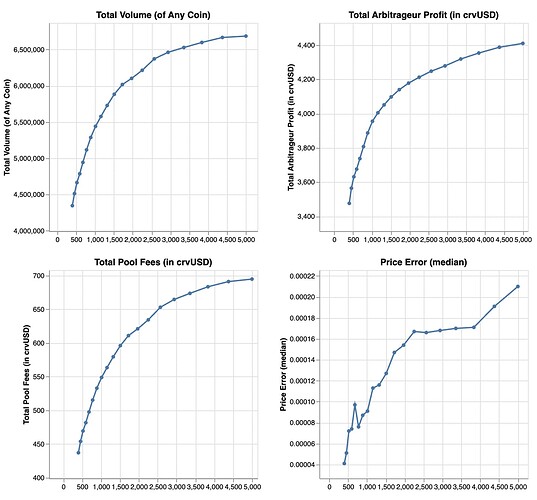

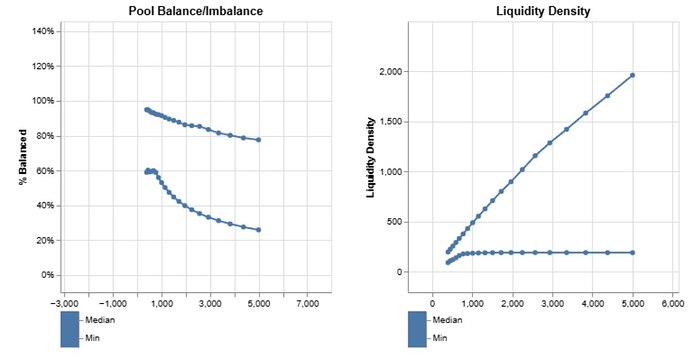

We’ve run simulations going back to January 2025 and these provide a good indication that ramping A to 2000 is reasonably safe, contributing to increased arbitrage volumes in the pools without having too adverse consequences for liquidity depth in general.

crvUSD/USDT

crvUSD/USDC

crvUSD/USDM

crvUSD/PYUSD

The DAO should be mindful that crvUSD mint rates have been quite low over this period and there has been fairly muted demand for leveraging volatile crypto assets. If demand for minting begins driving up rates (and depleting PegKeeper reserves) there may need to be intervention to protect the crvUSD peg. Our contingency plan is to monitor average PegKeeper reserves and crvUSD mint rates. If rates trend toward 10% (the baseRate) is may become advisable to increase baseRate for minting crvUSD, thus protecting a buffer of PegKeeper debt and assurances that the peg strength remains strong.

Specification:

There will be two votes since the USDT and USDC pools are governed by the parameter admin and the PYUSD and USDM pools are governed by the ownership admin.

FACTORY_ADMIN = '0x768caA20Cf1921772B6F56950e23Bafd94aF5CFF'

RAMP_TIME = chain.time() + (86400 * 14)

ACTIONS = [

# crvUSD/USDT ramp A to 2000 over 1 week

(FACTORY_ADMIN, "ramp_A", "0x390f3595bCa2Df7d23783dFd126427CCeb997BF4", 2000, RAMP_TIME),

# crvUSD/USDC ramp A to 2000 over 1 week

(FACTORY_ADMIN, "ramp_A", "0x4DEcE678ceceb27446b35C672dC7d61F30bAD69E", 2000, RAMP_TIME),

]

ACTIONS = [

# crvUSD/PYUSD ramp A to 2000 over 1 week

("0x625E92624Bc2D88619ACCc1788365A69767f6200", "ramp_A", 2000, RAMP_TIME),

# crvUSD/USDM ramp A to 2000 over 1 week

("0x30cE6E5A75586F0E83bCAc77C9135E980e6bc7A8", "ramp_A", 2000, RAMP_TIME),

]