Summary

Add a gauge for the EYWA / crvUSD market (LlamaLend, Arbitrum) to the Curve Gauge Controller so that the market can receive CRV emissions.

- Market: https://curve.fi/lend/arbitrum/markets/one-way-market-21/create/

- Child Gauge (Arbitrum): https://arbiscan.io/address/0xc1b06b52848fd69d4734983d923e0a0101111e21

- Root Gauge (Ethereum): https://etherscan.io/address/0xc1b06b52848fd69d4734983d923e0a0101111e21

Market Parameters

| Parameter | Value |

|---|---|

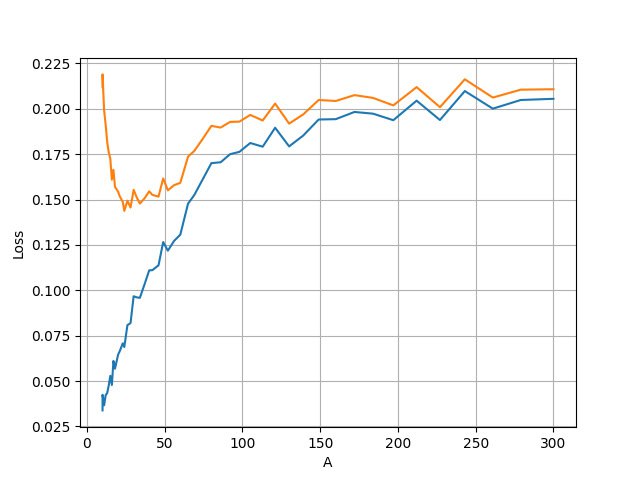

| Ideal A | 23 |

| liq_discount | 9 % |

| loan_discount | 12 % |

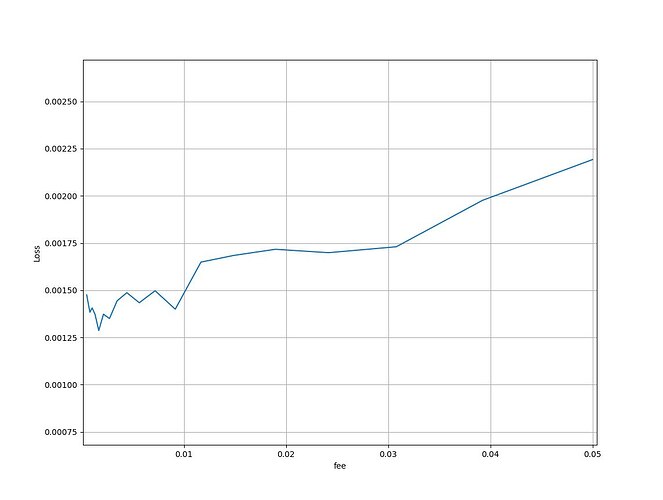

| fee | 0.0017 % |

These parameters were obtained with llama-simulator.

Motivation

CrossCurve’s partnership with Curve Finance and the launch of the EYWA / crvUSD gauge pursue two key objectives:

-

Expand EYWA’s utility as collateral.

A dedicated gauge makes EYWA more attractive to borrowers, strengthens the CrossCurve ↔ Curve synergy, and deepens liquidity in EYWA-related pools. -

Accelerate crvUSD-centric growth.

Markets that pair a volatile collateral asset with crvUSD-denominated debt consistently post steady TVL and volume growth, validating the model.

CRV emissions—combined with the EYWA incentive program funded by CrossCurve DAO—will amplify these benefits and speed up the development of both ecosystems.

Protocol Description

CrossCurve is an ecosystem that facilitates interaction between blockchains and consists of two main components:

- Consensus Bridge – a trust-minimised bridge for tokens and data that uses the consensus of the most secure cross-chain messaging protocols, such as Axelar, Chainlink CCIP, Layer Zero, and Wormhole.

- CrossCurve – an innovative cross-chain trading protocol that solves fragmented liquidity by leveraging Curve Finance liquidity pools.

Liquidity in CrossCurve is composed of s-tokens — collateralised synthetic assets issued by the Consensus Bridge. Each s-token is fully backed by the original asset locked in the EYWA Token Bridge on the source chain.

Governance

CrossCurve DAO is a democratic, transparent, and decentralized organization that makes strategic decisions, engages participants, and incentivizes their contributions.

The goal of CrossCurve DAO is to create long-term incentives for attracting sustainable cross-chain liquidity, as well as accumulating and managing the protocol’s own liquidity to ensure better conditions for cross-chain swaps in the market.

DAO governance is based on locking the EYWA governance token into veEYWA, which grants voting power. This voting power allows veEYWA holders to participate in decision-making, receive incentives, and earn income from CrossCurve protocols.

Useful Links

- Website: https://app.crosscurve.fi/

- Documentation: https://docs.crosscurve.fi/

- Github Page: EYWA Cross-chain Protocol · GitHub

- DefiLlama: https://defillama.com/protocol/crosscurve-(by-eywa)

- Discord: EYWA community

- Twitter: x.com

- Linkedin: | CrossCurve | LinkedIn

- Telegram: Contact