Summary:

Proposal to add ebUSD/USDC pool on to the Curve Gauge Controller.

References/Useful links:

Protocol Description:

Overview

Ebisu Money is a stablecoin credit protocol on Ethereum built using the Liquity v2 CDP standard. Users can borrow against bluechip collateral (BTC, ETH, and USD denominated assets) at user-set rates, receiving loans denominated in ebUSD, an overcollateralized USD-pegged stablecoin.

ebUSD holders can participate in these credit markets by providing liquidity to Stability Pools and DEXs, earning real yield from borrower interest and liquidation gains.

Solvency

All ebUSD is fully backed by overcollateralized debt. Stability Pools (funded in ebUSD) absorb debt during liquidations; ultimately fellow borrowers collectively act as guarantors of last resort.

Peg Stability

Redemptions: 1 ebUSD is directly redeemable for $1 worth of collateral. Redemptions target loans with the lowest interest rates and do not result in losses for borrowers, as the loan debt is reduced proportionally to the redeemed amount.

Effect: Redemptions create a hard peg at $1 by creating buy pressure and shrinking ebUSD supply during depegs. The mechanism also raises system-wide borrowing rates, tightening issuance.

Demand Drivers

- 75% of protocol interest revenue is directed to Stability Pool depositors to support liquidations.

- Protocol Incentivized Liquidity (PIL): 25% of ebUSD is directed to third-party venues (DEXs, lending markets etc.) to support ebUSD growth. Controlled by Ebisu Labs pre-TGE; governance will transfer to EBISU token holders post-TGE.

- Long-term ebUSD utility stems from third-party integrations and demand from entities seeking alternatives to fiat-backed stablecoins.

Together Redemptions and demand-drivers ensure ebUSD trades at $1 across secondary markets.

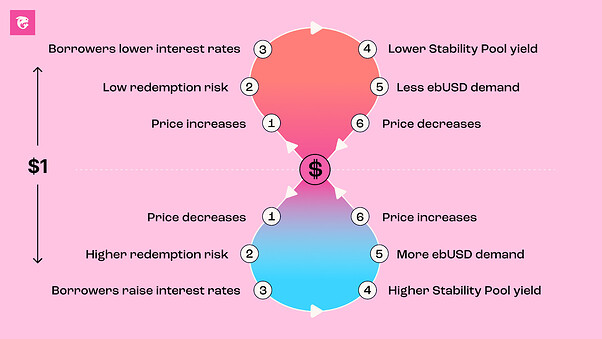

Dynamic Rate Equilibrium

This “user-set rate” mechanism invented by Liquity enables Ebisu to autonomously discover rates through free market forces.

Borrowers define the interest rate they are willing to pay, and redemption mechanics ensure that only correctly priced debt remains in the system. What emerges is Ebisu’s rates self-regulate towards the true cost of capital for each collateral type — without dependencies on principal agents.

Motivation:

The ebUSD/USDC Curve Pool is the first DEX pool for ebUSD. Building deep liquidity paired with a trusted stablecoin like USDC is critical for peg stability, borrower utility, and wider adoption.

Ebisu Labs believes the ebUSD-USDC pool will be a primary ebUSD liquidity venue – to support the pool’s growth, Ebisu Labs commits to:

- Allocating 25% of protocol interest revenue and USDC-denominated incentives to this pool’s gauge.

- Utilizing its 8,838 LQTY treasury position and collaborating with other LQTY holders to direct further PIL toward ebUSD gauges.

Specifications:

- Governance: Provide current information on the protocol’s governance structure. Provide links to any admin and/or multisig addresses, and describe the powers afforded to these addresses. If there are plans to change the governance system in the future, please explain.

Pre-TGE: The protocol is managed by the Ebisu Labs team via the Ebisu Maintainer multisig (⅔ Gnosis Safe).

- Multisig: 0x25b85831DA750C912Ab7F0cf53B9D82F7894ed07

- Signers:

- 0xb18C27B28Bca47Eb4492e02630C52654c71cd76B

- 0x9a89F2595E6C8a63f1870861F8a5113523b4bF99

- 0x016Ea729ca9a50D29D1058AAa6d975F7c905E82E

Post-TGE: Governance will transition to the Ebisu DAO using Snapshot and Aragon.

Ebisu Maintainer & Governance Permissions:

Ebisu’s vision is to become a premier onchain venue for dollar credit on Ethereum. Achieving this vision involves enabling Ebisu Money to onboard new blue-chip tokenized assets as collateral for ebUSD. The following features were created so Ebisu Maintainer, Ebisu DAO, and whitelisted security managers have the tools needed to properly manage risk as a multi-collateral CDP.

| Feature | Before Governance Address is Set | Post Governance | Time Lock |

|---|---|---|---|

| Change collateral MCR | Ebisu Maintainer & whilelisted Security Manager(s) | Governance & whitelisted Security Manager(s) | 24 hours |

| Change collateral debt cap | Ebisu Maintainer & whilelisted Security Manager(s) | Governance & whitelisted Security Manager(s) | |

| Change collateral minimum interest rate change | Ebisu Maintainer & whilelisted Security Manager(s) | Governance & whitelisted Security Manager(s) | 24 hours |

| Change collateral SP yield split | Ebisu Maintainer & whilelisted Security Manager(s) | Governance & whitelisted Security Manager(s) | 24 hours |

| Change collateral CCR | Ebisu Maintainer & whilelisted Security Manager(s) | Governance & whitelisted Security Manager(s) | |

| Change collateral Redemption Fee Floor | Ebisu Maintainer & whilelisted Security Manager(s) | Governance & whitelisted Security Manager(s) | |

| Pause minting per collateral | Ebisu Maintainer & whilelisted Security Manager(s) | Governance & whitelisted Security Manager(s) | |

| Unpause minting per collateral | Ebisu Maintainer & whilelisted Security Manager(s) | Governance & whitelisted Security Manager(s) | |

| Set governance address | Ebisu Maintainer & whilelisted Security Manager(s) | Only governance (ebisuMaintainer can do it if not disabled by Governance) | |

| Disable setting new governance address | Only governance | ||

| Whitelist new collateral token | Ebisu Maintainer | Only governance | |

| Deploy new collateral branches | Ebisu Maintainer | Only governance | |

| Renounce Ebisu Maintainer ability to deploy new branch | Only governance |

- Oracles: Does the protocol rely on external oracles? If so, provide details about the oracles and their implementation in the protocol.

Ebisu Money uses Chainlink and Redstone oracles as price sources for supported collaterals. The system includes oracle staleness detection that automatically shuts down the affected collateral branch. Upon shutdown, redemptions proceed using the last recorded valid price.

| Oracle | Provider | Deviation Threshold (%) | Address |

|---|---|---|---|

| sUSDe/USD | Redstone | 0.2 | 0xb99D174ED06c83588Af997c8859F93E83dD4733f |

| USDe/USD | Redstone | 0.2 | 0xbC5FBcf58CeAEa19D523aBc76515b9AEFb5cfd58 |

| weETH/ETH | Chainlnk | 0.5 | 0x5c9C449BbC9a6075A2c061dF312a35fd1E05fF22 |

| LBTC/BTC | Chainlink | 0.5 | 0x5c29868C58b6e15e2b962943278969Ab6a7D3212 |

| BTC/USD | Chainlink | 0.5 | 0xF4030086522a5bEEa4988F8cA5B36dbC97BeE88c |

| WBTC/USD | Chainlink | 2 | 0xfdFD9C85aD200c506Cf9e21F1FD8dd01932FBB23 |

| ETH/USD | Chainlink | 0.5 | 0x5f4eC3Df9cbd43714FE2740f5E3616155c5b8419 |

- Audits: Provide links to audit reports and any relevant details about security practices.

Ebisu Money has been audited by Dedaub; an earlier version of the protocol was audited by Zenith and Alex from Recon.

The Liquity v2 codebase, which serves as the foundation of the Ebisu Money protocol, has been through several audit and formal verification

Ebisu Labs works with Anthias Labs on risk management and parameterization to ensure the system is economically robust.

- Centralization vectors: Is there any component of the protocol that has centralization vectors? E.g. if only 1 dev manages the project, that is a centralized vector. If price oracles need to be updated by a bot, that is a centralized vector. If liquidations are done by the protocol, that is also a centralization vector.

The codebase is upgradable (deployment addresses), to allow for timely responses to security issues or critical updates. Post-TGE, Ebisu Labs is committed to revoke upgradability and transition remaining governance controls to the DAO.

Liquidations and redemptions are permissionless and handled by bots.

- Market History: Has the asset observed severe volatility? In the case of stablecoins, has it depegged? In the case of an unpegged asset, have there been extreme price change events in the past? Provide specific information about the Curve pool: how long has it been active, TVL, historical volume?

Ebisu Money has been deployed on mainnet for 1 month in a “private mainnet” phase. The primary goals of the private mainnet were to test the protocol, get feedback from early users, and bootstrap initial TVL and secondary liquidity.

Currently (7/23/2025) Ebisu Money has:

- $950K of collateral

- 395K ebUSD minted

- ebUSD/USDC Curve pool with $230K in TVL

Ebisu’s peg stability mechanisms mirror those of Liquity v2’s BOLD, which have demonstrated resilience (BOLD/USDC).

Multiple partners are currently operating liquidation and redemption bots. Peg tightness is expected to increase as ebUSD supply grows as redemption size will be larger, making gas costs less dominant.

Team & Backers

Ebisu Money is developed by Ebisu Labs, and is backed by angels and advisors such as DCF God, Sam Kazemian, Jai Bhavnani, kinnif, 0xMinion, Yieldfarming, LlamaIntern, Zellic, Ottersec, Pashov, Veil, Scott Moore, Garrett MacDonald, Nathan Worsley, Kairos Research, Shoal Research, Renat Khasanshyn, Anthias, and more.