Summary:

Reduce the trading fee of Curve Pool 0x21E27a5E5513D6e65C4f830167390997aA84843a (stETH/ETH) from 0.04% to 0.008%, in order to improve competitiveness and enable the pool to capture CowSwap volume currently flowing elsewhere.

Abstract:

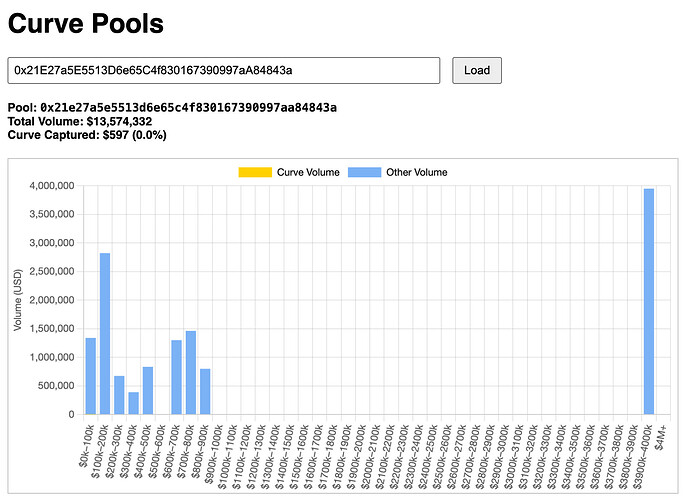

This proposal recommends reducing the base fee of the stETH/ETH pool from 0.04% to 0.008%. The pool currently captures effectively 0% of CowSwap volume for this pair, despite the presence of meaningful demand routed through other venues.

Competing pools on platforms like Uniswap and Balancer operate at a 0.1% fee, yet still attract significant order flow due to solver preference and integration. Lowering the Curve pool’s fee to 0.008% aims to make it competitive enough to enter the solver’s routing set and start attracting meaningful volume.

Motivation:

Order flow analysis shows that the Curve stETH/ETH pool currently captures none of the CowSwap volume for this pair — despite offering deeper and more stable liquidity than many alternatives.

This is not due to inferior mechanics, but rather because the current fee of 0.04% is still too far from the marginal solver path, and thus fails to be considered for execution.

Reducing the fee to 0.008% makes the pool far more attractive in the context of CowSwap’s pricing logic, especially when competing routes sit around 0.1%.

Attached is a chart showing current CowSwap routing patterns for the 2nd biggest stETH/ETH Pool on Curve, illustrating the absence of Curve as a destination under the current configuration.

Specification:

POOL = "0x21E27a5E5513D6e65C4f830167390997aA84843a"

ACTIONS = [

# Lower base fee to 0.008% (800,000)

('0x742c3cf9af45f91b109a81efeaf11535ecde9571', "commit_new_fee", POOL, 800000)

]