Summary:

Increase the trading fee of Curve Pool 0xD001aE433f254283FeCE51d4ACcE8c53263aa186 (RLUSD/USDC) from 0.01% to 0.02%, while keeping the offpeg fee multiplier fixed at 5, based on observed CowSwap order flow and expected LP revenue gains.

Abstract:

This proposal suggests increasing the fee of the RLUSD/USDC pool on Curve from 0.01% to 0.02%. CowSwap order flow data shows that Curve is already the preferred routing venue for this pair, capturing a meaningful share of traded volume despite a competing Uniswap v3 pool with only ~$2M TVL.

Raising the fee is expected to improve LP earnings with minimal loss of routed volume, as the Curve pool continues to offer strong execution efficiency. The offpeg fee multiplier remains unchanged at 5.

Motivation:

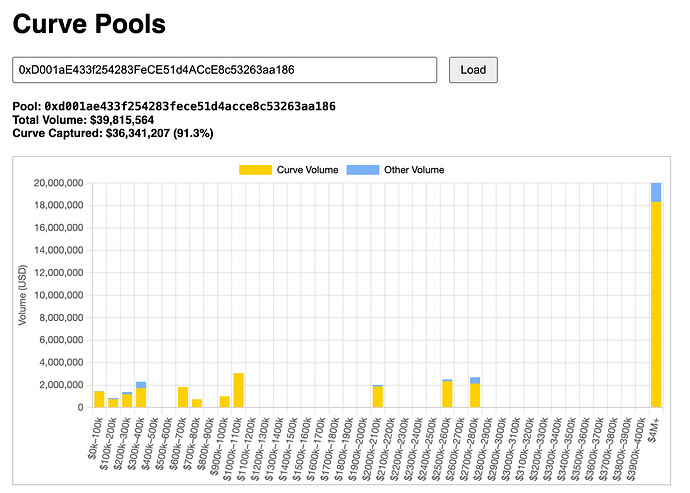

Order flow analysis shows that the Curve pool at 0xd001ae433f254283fece51d4acce8c53263aa186 captures 91.1% of CowSwap trade volume for the RLUSD/USDC pair — amounting to $28,437,567 out of a total $31,231,060.

This high capture rate highlights a clear and consistent routing preference, particularly across all trade size buckets. Despite the presence of a competing Uniswap v3 pool (~$2M TVL), Curve’s deeper liquidity and more stable pricing continue to make it the preferred destination for CowSwap solvers.

Increasing the base fee to 0.02% is expected to significantly improve LP revenue while preserving routing dominance. Testing with historical CowSwap order flow shows that similar pools maintain nearly the same volume share, but earn substantially more in trading fees.

Specification:

POOL = "0xD001aE433f254283FeCE51d4ACcE8c53263aa186"

ACTIONS = [

# Set base fee to 0.02% (2,000,000), offpeg_fee_multiplier to 5 (50,000,000,000)

(POOL, "set_new_fee", 2000000, 50000000000)

]

```