Summary

We propose to terminate gauge emissions for the following Curve pools:

This will only stop CRV emissions to the pools and will not affect any other pool functionality.

Motivation

The rationale is based on observed liquidity concentration, low market activity, and the resulting emissions inefficiency.

Curve emissions are designed to support decentralized, widely used pools that bring utility to traders, LPs, and the ecosystem at large. In the case of these two pools, however, recent analysis reveals:

- Extreme LP concentration - a single wallet controls the overwhelming majority of liquidity in each pool.

- Minimal organic activity - limited or no meaningful trading volume or organic usage.

- Emissions inefficiency - gauge rewards are disproportionately funneled to one party, undermining the goal of broad incentive distribution.

In such cases, emissions are unlikely to support meaningful network growth or usage and may be better allocated elsewhere.

Supporting Data

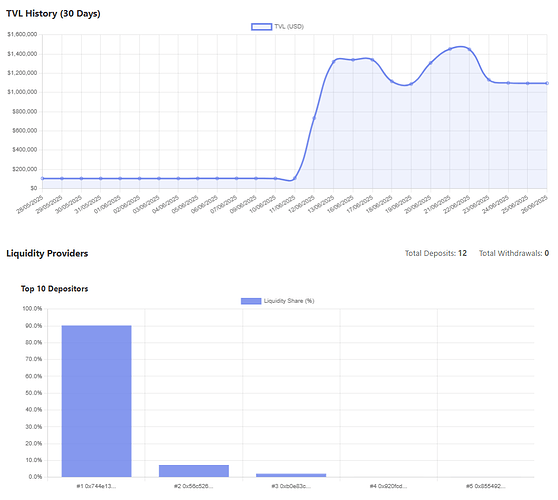

wA7A5-USDT Pool

Contract: 0xeb593fe90591923FDdd97F2e5fCb1a14CE656E5D

Gauge: 0x91D0F7022edb620429B4F63D482fcfbb2cbE7F30

Source: Gauge Check - Curve Monitor

Observation: While the wA7A5-USDT pool displayed growth in TVL following gauge approval on May 23 and gauge weighting on June 12, 90% is still concentrated in a Single LP.

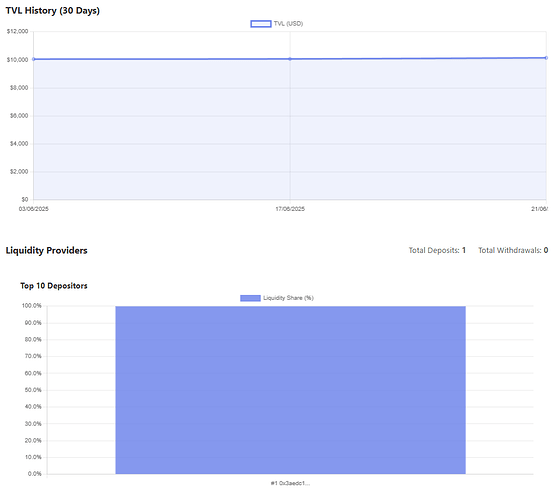

wa7a5-crvUSD Pool

Contract: 0x0d10FA76a79824282dfB9f6779f64A4BB7D75bd5

Gauge: 0x61EF4C94D4b22eBC27168a2f9e7B0Fb9608d0360

Source: Gauge Check - Curve Monitor

Observation:

- The

wa7a5-crvUSDpool contains one LP providing 100% of the liquidity. - TVL Growth is flat since the 03/06/2025

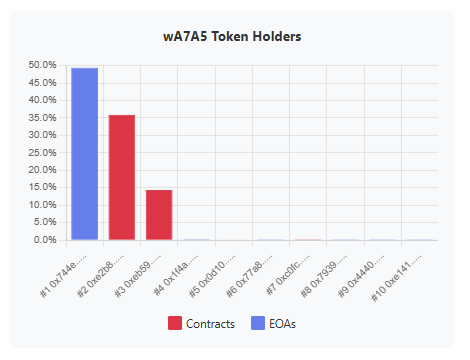

Tokenholder Distribution (wA7A5)

Source: Gauge Check - Curve Monitor

Observation:

- No significant wallet diversification of the wA7A5 token with a single EOA holding 50% of the supply. This is the same address that makes up a 90% share of the wA7A5-USDT pool.

Proposed Action:

We propose to kill gauges for both pools. This ensures:

- Emissions are redirected toward more active and decentralized pools.

- The DAO maintains a precedent of upholding minimum standards for gauge support.

- Stakeholders are encouraged to develop pools with demonstrable demand and diversified participation.

This proposal does not preclude future resubmission should the pools evolve in composition or activity.

Specification

ACTIONS = [

("0xd85C478A7828734376bC6Bc77373a260CC3A9407", "set_killed", True), # Gauge for wa7a5-USDT

("0x28c164164EF91336Ae4b36C30Cdb2Ff0b77dE37b", "set_killed", True), # Gauge for wa7a5-crvUSD

]