Summary:

Proposal to add MUSD/sUSDe Pool on Ethereum to the Gauge Controller

References/Useful links:

Link to:

Protocol Description:

Ethena sUSDe - Overview

sUSDe is the reward-accruing version of USDe. In order to receive rewards, users must stake their USDe to receive sUSDe.

Ethena earns protocol rewards from three different sources today, with the main source originating from Ethena’s short perpetual futures positions that collect funding rates on exchanges.

In 2024, BTC funding rates averaged 11%, while ETH funding rates averaged 12.6%.

sUSDe APY averaged 19% in 2024.

See Historical Examples for a detailed breakdown of funding rate historical data.

Mezo - Overview

Mezo is a Bitcoin-centric platform purpose-built to make Bitcoin productive in day-to-day finance. It is EVM-compatible, which means it can host decentralized apps (dApps) and smart contracts in a system that developers and users already understand.

Using tBTC’s infrastructure as a secure and decentralized foundation, Mezo aims to offer a platform where people can use their Bitcoin in the following ways:

Mortgages funded by BTC collateral

Everyday purchases made through Bitcoin-backed credit lines

Grow wealth without ever selling

This is what it means to make Bitcoin supernormal. Mezo’s goal is to embed Bitcoin so deeply within existing financial systems that using it feels as natural as swiping a debit card.

Mezo design features

MUSD and Borrow: Tap into your Bitcoin equity at competitive, fixed rates. Borrowers create MUSD by opening a Collateralized Debt Position (CDP), posting BTC as collateral to mint MUSD, a dollar-pegged stablecoin usable for spending, trading, lending, and borrowing.

BTC for Gas: Mezo Network uses BTC as its native gas token. This maintains a pure Bitcoin experience and advances Bitcoin as a cultural payment currency while providing a stream of fee revenue paid in BTC.

tBTC Integration & Multi-Chain Support: Mezo is built on tBTC, the largest decentralized Bitcoin bridge in production. By robustly tokenizing Bitcoin, holders can utilize their Bitcoin across EVM chains in a secure and reliable manner. Reserves are verifiable 24/7 at tbtc.scan.

Dual Staking Model: Combines rewards and validation to incentivize network participation and security.

BitcoinFi Ecosystem: A suite of Bitcoin-native financial applications, including lending, borrowing, and yield generation.

Developer-Friendly Environment: Supports Ethereum and Cosmos developers.

MUSD - Overview

MUSD is a permissionless stablecoin 100% backed by Bitcoin reserves and designed to maintain a 1:1 peg with the U.S. dollar. It is the native stablecoin on Mezo, accessible via Mezo’s ‘Borrow’ feature or decentralized exchanges on Mezo Network.

Anyone can mint MUSD by depositing BTC into Mezo borrow, thus creating a loan position. Bitcoin collateral for MUSD positions is publicly verifiable onchain, and proof-of-reserves are viewable 24-7. For more details on the collateral management, see the “Collateral Management” section. Users can close their MUSD positions by returning the borrowed MUSD and accumulated interest to receive their initial Bitcoin collateral.

You must deposit a minimum of $1800 US worth of BTC or other supported tokens as collateral in order to create a loan.

How MUSD Works

MUSD uses a CDP (collateralized debt position) model.

Every outstanding MUSD is redeemable for Bitcoin.

$1 in BTC collateral can be used to mint 1 MUSD

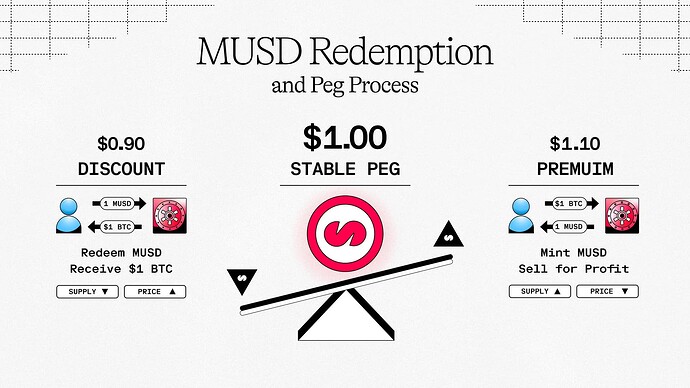

The mint-and-redeem model helps maintain the $1 peg in volatile environments. For example, MUSD may trade on the market at a premium or discount to its $1 stable value. Below are the scenarios for how the peg can be re-established.

If MUSD is trading at a discount of $0.99, arbitragers can buy MUSD on the market and redeem it for $1 in underlying BTC. Users with a loan position can do this for no additional cost. Those without a loan position must pay a 0.75% redemption fee, which remains profitable until MUSD reaches a price of $0.995.

If MUSD is trading at a premium of $1.05, arbitragers can mint MUSD by supplying BTC to the protocol and sell the minted MUSD on the market for a profit; selling into another dollar-equivalent stablecoin like USDT or USDC. This scenario remains profitable until MUSD returns to a price of $1.005.

To ensure the peg is maintained during market volatility, sufficient BTC collateral must always back the outstanding MUSD. Outstanding loan positions must maintain a collateral ratio of above 110%, and the system has built-in liquidation mechanisms and stability pools to enforce this. These risk mitigations ensure that even with high LTVs, the system remains secure and resilient against market volatility.

Details on liquidations and risks can be read in further detail HERE.

Motivation:

Deepen liquidity for MUSD on Ethereum leading up to Mezo’s TGE

Specifications:

Governance

- sUSDe (Ethena)’s Governance Structure

- Mezo is currently pre-TGE. The structure will be based on a dual staking model governed by veBTC and veMEZO.

Oracles

MUSD specifically is not dependent on external oracles. It uses its redemption mechanism and arbitrage incentives to maintain its peg.

Audits

Mezo App and Passport

mezod

MUSD

Market History

Both MUSD and sUSDe have not experienced any significant depeg event.

MUSD/sUSDe Curve Pool History