Summary:

What has been built can remain, but further development maybe should stop.

Abstract:

L2s eat the time of talented devs. Each of those chains require at least the same care as Ethereum, while giving back only very little. By cutting all development in this direction, Curve can regain the head-space to push into more fruitful directions.

Motivation:

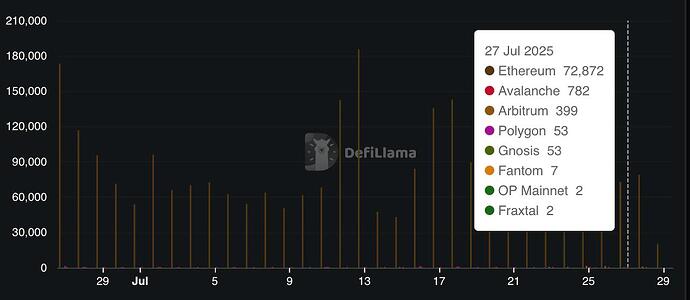

Bringing Curve to L2s has been tried now, but the stats speak for themselves. Very little returns (about 1,500$ per day, all L2s combined) while consuming lots of dev time to develop, while also having mostly much higher maintenance cost due to their fast paste, short lived, nature.

Specification:

Practically this means:

What currently runs can keep running, but lets delete for all Curve Devs all L2-linked entries on their to-do-lists

For:

Builders could spend their productive time on more meaningful things

Against:

Perhaps there are bigger opportunities for Curve to be found on L2s, that haven’t been so yet.

Poll:

Cut L2 development?

- Don’t cut L2 development

- Reduce L2 development

- Cut L2 development

0 voters